Navigating auto loans in Canada can be complex, with each province and territory having unique regulations, rates, and requirements. Whether you’re buying your first car in British Columbia or upgrading your vehicle in Quebec, understanding regional differences can help you secure better financing terms. This comprehensive guide breaks down everything you need to know about auto loans across Canada in 2025, helping you drive home your dream vehicle with confidence.

Understanding Auto Loans in Canada: The Basics

Auto loans in Canada function similarly across provinces, but important regional differences can impact your financing options. Before diving into province-specific details, let’s cover the fundamentals that apply nationwide.

Types of Auto Financing Available

- Bank auto loans (TD, RBC, CIBC, etc.)

- Dealership financing (manufacturer-backed)

- Credit union auto loans

- Online lenders and brokers

- Specialized financing for challenged credit

What Affects Your Auto Loan Terms

- Credit score and history

- Income and employment stability

- Down payment amount

- Loan term length (typically 36-96 months)

- New vs. used vehicle status

- Provincial regulations and taxes

Ready to explore your auto loan options?

Get personalized rates from multiple lenders with a single application.

How Auto Loans Differ Across Canadian Provinces

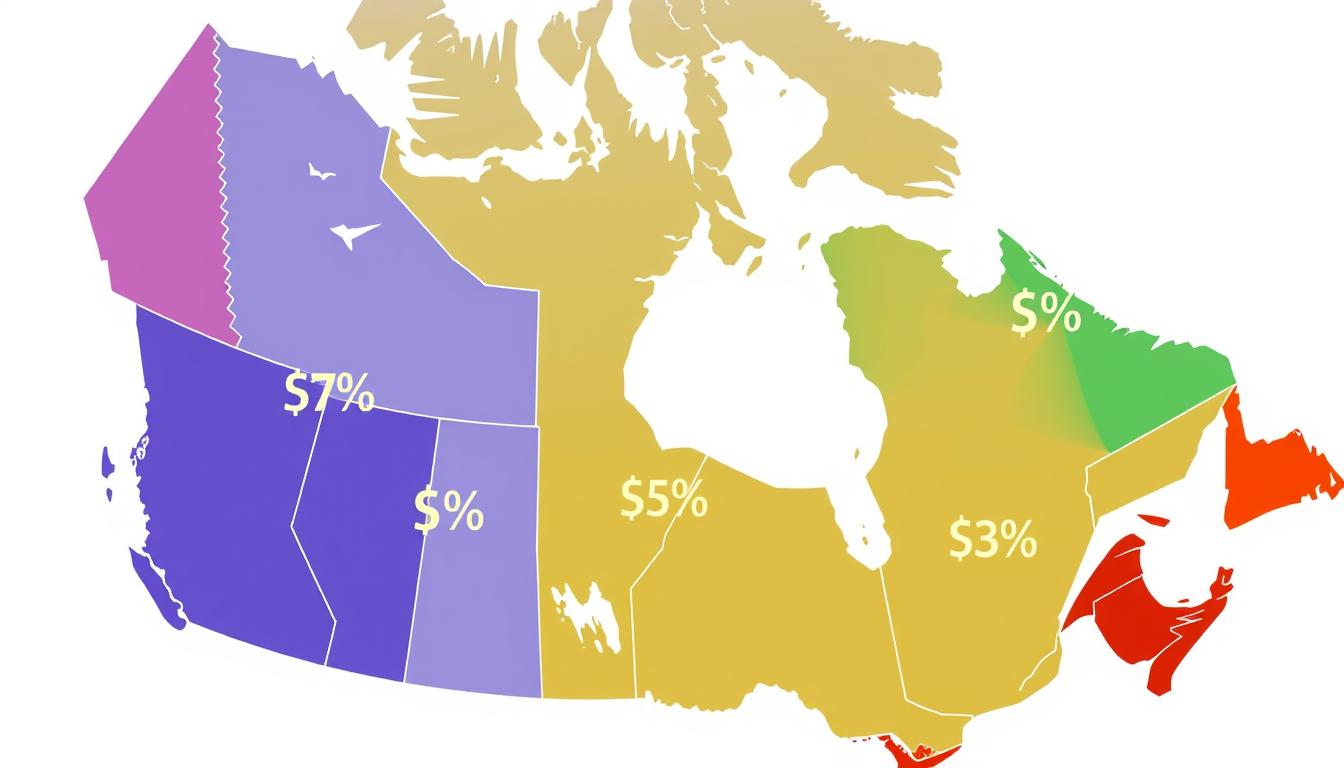

While the basic structure of auto loans remains consistent across Canada, provincial regulations, taxes, and market conditions create notable differences in what you can expect. Here’s a breakdown of the key variations you should be aware of:

| Factor | Provincial Variation | Impact on Auto Loans |

| Sales Tax | Ranges from 5% GST only to 15% HST | Affects total financed amount and monthly payments |

| Registration Fees | $15-$200+ depending on province | May be included in loan amount |

| Insurance Requirements | Public vs. private insurance systems | Affects overall vehicle ownership costs |

| Cooling-Off Periods | Varies by province (0-2 days) | Affects contract cancellation rights |

| Interest Rate Caps | Some provinces have maximum rates | May limit rates for certain borrowers |

Auto Loans in Ontario

As Canada’s most populous province, Ontario has a competitive auto financing market with numerous options for borrowers. The province’s strong consumer protection laws also provide important safeguards when financing a vehicle.

Key Ontario Auto Loan Considerations

- Provincial Tax: 13% HST applies to vehicle purchases, increasing the amount you’ll need to finance

- Consumer Protection: Ontario’s Motor Vehicle Dealers Act provides strong buyer protections for dealership purchases

- Insurance Costs: Ontario has among the highest auto insurance rates in Canada, affecting your overall vehicle budget

- Electric Vehicle Incentives: Provincial incentives may be available for green vehicle purchases, potentially reducing financing needs

Auto Loans in Quebec

Quebec’s unique legal system and strong consumer protection laws create a different auto financing landscape compared to other provinces. Borrowers should be aware of several Quebec-specific factors when seeking auto loans.

Key Quebec Auto Loan Considerations

- Provincial Tax: 9.975% QST plus 5% GST applies to vehicle purchases

- Consumer Protection: Quebec’s Consumer Protection Act provides a 2-day cooling-off period for certain financing contracts

- Documentation: All contracts must be available in French, and many lenders require French documentation

- Public Insurance: Basic insurance is provided through the public system (SAAQ), but additional coverage is needed

Auto Loans in British Columbia

British Columbia’s auto financing market offers competitive rates and strong consumer protections. The province’s emphasis on green vehicles also creates unique opportunities for eco-conscious borrowers.

Key British Columbia Auto Loan Considerations

- Provincial Tax: 7% PST plus 5% GST applies to vehicle purchases

- Insurance System: ICBC provides basic mandatory coverage, with optional additional coverage

- Green Vehicle Incentives: BC offers some of Canada’s most generous EV incentives, potentially reducing financing needs

- Luxury Vehicle Tax: Additional tax on vehicles over $55,000 may increase financing requirements

Auto Loans in Alberta

Alberta’s strong economy and tax advantages create a favorable environment for auto financing. With no provincial sales tax, Albertans can often finance less than residents of other provinces for the same vehicle.

Key Alberta Auto Loan Considerations

- Provincial Tax: Only 5% GST applies to vehicle purchases (no provincial sales tax)

- Private Insurance: Competitive private insurance market with various options

- Registration Fees: Registration costs vary based on vehicle weight and type

- Economic Factors: Alberta’s resource-based economy can affect loan approval criteria during economic fluctuations

Auto Loans Across Other Canadian Provinces and Territories

Each remaining province and territory has its own unique considerations for auto financing. Here’s what you need to know about securing auto loans in these regions:

Manitoba

- Public insurance through Manitoba Public Insurance (MPI)

- 7% PST plus 5% GST on vehicle purchases

- Strong credit union presence offering competitive rates

Saskatchewan

- Public insurance through SGI with optional additional coverage

- 6% PST plus 5% GST on vehicle purchases

- Lower average insurance costs than many provinces

Nova Scotia

- 15% HST applies to vehicle purchases

- Private insurance market with varying rates

- Vehicle branding and history checks are essential

New Brunswick

- 15% HST applies to vehicle purchases

- Private insurance system with competitive rates

- Strong consumer protection for financing contracts

Newfoundland and Labrador

- 15% HST applies to vehicle purchases

- Higher insurance rates than some provinces

- Remote areas may have fewer financing options

Prince Edward Island

- 15% HST applies to vehicle purchases

- Private insurance market with varying rates

- Smaller market may limit dealership financing options

Looking for auto financing in your province?

Compare personalized rates from multiple lenders with one simple application.

Auto Loans in Canada’s Northern Territories

Canada’s territories present unique challenges and considerations for auto financing due to their remote locations, smaller populations, and distinct economic conditions.

Northwest Territories

- Only 5% GST applies to vehicle purchases

- Higher vehicle costs due to shipping expenses

- Limited local dealership options may require out-of-territory financing

Yukon

- Only 5% GST applies to vehicle purchases

- Private insurance system with rates reflecting northern conditions

- Some lenders offer northern living allowances in qualification criteria

Nunavut

- Only 5% GST applies to vehicle purchases

- Limited road infrastructure affects vehicle types financed

- Many communities accessible only by air, limiting vehicle financing

Special Auto Loan Considerations for Canadian Borrowers

Beyond provincial differences, several special circumstances may affect your auto loan application and terms. Understanding these factors can help you navigate the financing process more effectively.

Newcomers to Canada

Many Canadian financial institutions offer specialized auto loan programs for newcomers who have limited or no Canadian credit history. These programs typically require:

- Proof of permanent residence or work permit

- Minimum employment period in Canada (usually 3-6 months)

- Valid Canadian driver’s license

- Proof of income and employment

Newcomer programs often feature competitive rates and flexible down payment requirements to help new Canadians establish transportation and credit history simultaneously.

Credit-Challenged Borrowers

If you have less-than-perfect credit, specialized financing options are available across all provinces. These typically involve:

- Higher interest rates than prime loans

- Potentially larger down payment requirements

- Shorter maximum loan terms

- More stringent income verification

Working with lenders who specialize in credit-challenged auto loans can help you rebuild your credit while securing necessary transportation.

Facing credit challenges or new to Canada?

We work with lenders specializing in unique borrower situations.

Financing Electric and Hybrid Vehicles in Canada

With Canada’s push toward greener transportation, many lenders now offer specialized financing for electric and hybrid vehicles. These programs often feature preferential rates and terms to encourage eco-friendly vehicle purchases.

Green Vehicle Financing Benefits

- Preferential Rates: Many lenders offer rate discounts of 0.25-0.50% for qualifying green vehicles

- Extended Terms: Longer financing terms may be available, reflecting the durability of electric drivetrains

- Federal Incentives: Up to $5,000 in federal incentives may reduce financing needs

- Provincial Programs: Additional provincial incentives in BC, Quebec, and other provinces

Frequently Asked Questions About Auto Loans in Canada

How do provincial differences affect my auto loan?

Provincial differences impact your auto loan through varying tax rates (from 5% GST only in Alberta and territories to 15% HST in Atlantic provinces), different insurance systems (public vs. private), and unique consumer protection laws. These factors affect both the total amount you need to finance and the terms lenders may offer in your province.

What credit score do I need for an auto loan in Canada?

While requirements vary by lender, generally a score of 650+ will qualify you for competitive rates across Canada. Scores between 600-649 may still qualify but with higher rates, while scores below 600 typically require specialized financing. Some lenders offer newcomer programs that don’t rely on Canadian credit history.

Should I finance through a dealership or get a pre-approved loan?

Both options have advantages. Dealership financing offers convenience and sometimes special manufacturer rates, while pre-approved loans give you negotiating power and clarity on your budget before shopping. The best approach is to compare both options to secure the most favorable terms for your situation.

How long can I finance a car in Canada?

Standard auto loan terms in Canada range from 36 to 96 months (3-8 years). Longer terms reduce monthly payments but increase total interest paid. Most lenders offer maximum terms of 84 months for new vehicles and shorter terms for used vehicles based on age. Some specialized lenders may offer terms up to 96 months for qualified borrowers.

Can I get an auto loan as a newcomer to Canada?

Yes, many Canadian financial institutions offer specialized newcomer auto loan programs. These typically require proof of permanent residence or work permit, 3-6 months of Canadian employment history, a valid Canadian driver’s license, and proof of income. These programs are designed to help newcomers establish transportation and credit history simultaneously.

Finding Your Best Auto Loan in Canada

Navigating auto loans across Canada’s diverse provinces and territories requires understanding both national lending practices and regional variations. By considering the provincial factors outlined in this guide, you can approach your vehicle financing with confidence and secure terms that work for your specific situation.

Remember that comparing multiple loan offers is the best strategy for finding competitive rates, regardless of which province you call home. Taking the time to understand your options can save you thousands over the life of your loan.

Ready to drive home your dream vehicle?

Compare personalized auto loan offers from multiple lenders with one simple application.